New Mexico Crypto Tax Calculator

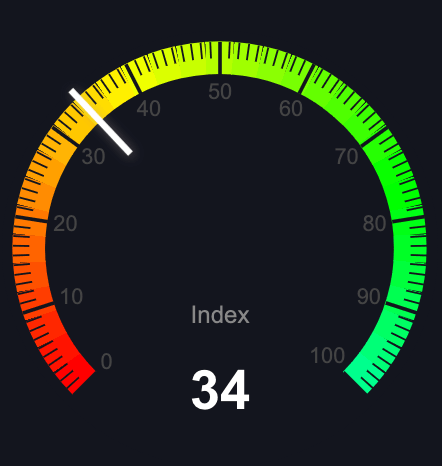

We built this free crypto tax calculator for residents of New Mexico who want to check calculations quickly. Our calculator is for informational purposes only. Please consult a CPA or tax professional. Use cryptocurrency tax accounting software if you have lots of trades.

New Mexico taxes capital gains at rates from 1.7% to 5.9%, with a special 40% deduction for long-term gains. To calculate Federal taxes, please use our USA tax calculator.

Have a complex trading history?

Use Koinly to import your transactions and calculate your taxes.

Calculate for freeNew Mexico Tax Brackets (2024)

| Single Filers | Married Filing Jointly | Tax Rate |

|---|---|---|

| $0 to $5,500 | $0 to $8,000 | 1.70% |

| $5,500 to $11,000 | $8,000 to $16,000 | 3.20% |

| $11,000 to $16,000 | $16,000 to $24,000 | 4.70% |

| $16,000 to $210,000 | $24,000 to $315,000 | 4.90% |

| Over $210,000 | Over $315,000 | 5.90% |

Long-Term Capital Gains Deduction

New Mexico offers a special deduction for long-term capital gains (assets held for more than one year). You can deduct the greater of:

- $1,000, or

- 40% of your long-term capital gains

Cryptocurrency Taxation in New Mexico

Key Points

- Progressive Taxation: New Mexico taxes crypto gains at rates from 1.7% to 5.9%.

- Long-Term Benefits: Special 40% deduction available for long-term gains.

- Holding Period Matters: Consider holding assets for over one year to qualify for the deduction.

- Mining Income: Crypto mining is treated as self-employment income and taxed at regular income rates.

Common Tax Situations

Trading & Investment

All crypto trades are taxable events, but long-term holders can benefit from the special 40% deduction. Consider your holding period when planning trades.

Tax Planning Tips

The 40% deduction for long-term gains can significantly reduce your tax liability. Consider holding assets for over a year when possible, and time your sales to maximize the benefit of this deduction.