Massachusetts Crypto Tax Calculator

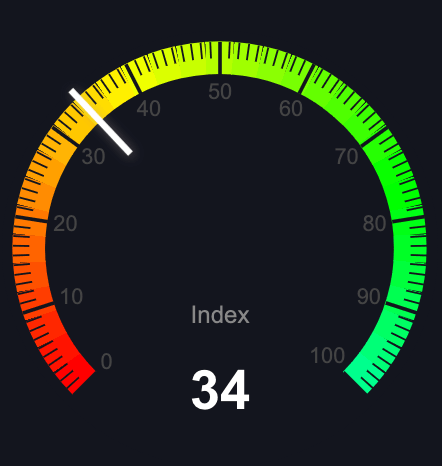

We built this free crypto tax calculator for residents of Massachusetts who want to check calculations quickly. Our calculator is for informational purposes only. Please consult a CPA or tax professional. Use cryptocurrency tax accounting software if you have lots of trades.

Massachusetts taxes short-term gains at 8.50% and long-term gains at 5.00%, with an additional 4% surtax on income over $1 million. To calculate Federal taxes, please use our USA tax calculator.

Have a complex trading history?

Use Koinly to import your transactions and calculate your taxes.

Calculate for freeMassachusetts Capital Gains Tax Rates (2024)

| Type of Gain | Base Rate | Rate with Surtax* |

|---|---|---|

| Short-term (< 1 year) | 8.50% | 12.50% |

| Long-term (≥ 1 year) | 5.00% | 9.00% |

* Surtax of 4% applies to total income over $1 million

Cryptocurrency Taxation in Massachusetts

Key Points

- Holding Period Matters: Massachusetts distinguishes between short-term (8.50%) and long-term (5.00%) gains.

- Millionaire Surtax: Additional 4% tax on income (including gains) over $1 million.

- Maximum Rates: Effective rates can reach 12.50% for short-term and 9.00% for long-term gains.

- Mining Income: Crypto mining is treated as self-employment income and taxed at regular income rates.

Common Tax Situations

Trading & Investment

Consider holding periods when trading. Long-term gains receive significantly better tax treatment (5.00% vs 8.50%).

Tax Planning Tips

If your total income is approaching $1 million, carefully plan your crypto sales to manage exposure to the 4% surtax. Consider spreading large gains across tax years.