Colorado Crypto Tax Calculator

We built this free crypto tax calculator for residents of Colorado who want to check calculations quickly. Our calculator is for informational purposes only. Please consult a CPA or tax professional. Use cryptocurrency tax accounting software if you have lots of trades.

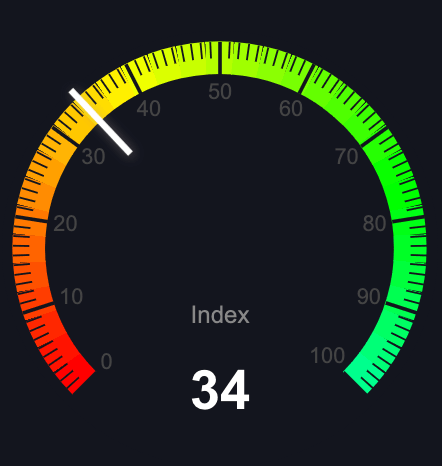

Colorado taxes all capital gains at a flat rate of 4.4%. To calculate Federal taxes, please use our USA tax calculator.

Have a complex trading history?

Use Koinly to import your transactions and calculate your taxes.

Calculate for freeHow to Use the Tax Calculator

- Enter the Total Cost of First Purchase: This is the initial amount you spent to buy the cryptocurrency.

- Enter the Amount of Sale: This is the total amount you received when you sold the cryptocurrency.

- Select your Holding Period: Choose whether you held the asset for more or less than one year (this is for your reference, as Colorado applies the same rate regardless).

- Click on the Calculate Tax button to get the estimated tax on your capital gains.

Note: This is an estimation and may not reflect your actual tax liability. Always consult with a tax professional when filing your taxes.

Cryptocurrency Taxation in Colorado

Colorado Crypto Tax Overview

Colorado has a straightforward approach to cryptocurrency taxation:

- Flat Tax Rate: Colorado applies a flat 4.4% tax rate to all capital gains, regardless of holding period or income level.

- Property Treatment: Like federal law, Colorado treats cryptocurrency as property for tax purposes.

- Mining Income: Cryptocurrency mining income is treated as self-employment income and is taxed at the same 4.4% rate.

Recent Developments

Colorado has emerged as a crypto-friendly state:

- Crypto for Taxes: Colorado became the first state to accept cryptocurrency for tax payments in 2022.

- Business Innovation: The state has attracted numerous blockchain and crypto businesses due to its favorable regulatory environment.

- Legislative Support: Colorado has passed several blockchain-friendly bills to promote innovation in the crypto space.

Common Colorado Crypto Tax Situations

Mining Operations

Crypto mining income is subject to Colorado's 4.4% tax rate. Miners can deduct business expenses including electricity costs and equipment depreciation.

Trading Between Cryptocurrencies

Crypto-to-crypto trades are taxable events in Colorado. Each trade must be reported and is subject to the 4.4% tax rate on any gains.

NFT Transactions

NFT sales are treated like other crypto transactions in Colorado, with gains taxed at 4.4%. Artists and creators must report NFT sales as income.

Tax Planning Considerations

- Track all crypto transactions carefully as Colorado requires reporting of all gains.

- Keep detailed records of acquisition costs and sale prices for accurate tax calculations.

- Consider timing of sales as losses can offset gains in the same tax year.

- Consult with a Colorado-based tax professional familiar with both state tax law and cryptocurrency.