Free Crypto Tax Calculator Australia for Capital Gains

We built this free crypto tax calculator for Australian users that want to check their gains quickly. Our calculator is for informational purposes only. Consult an expert CPA or tax professional. You can use more advanced crypto tax software if you have a lot of trades.

Have a complex trading history?

Use Koinly to import your transactions and calculate your taxes.

Calculate for freeHow to Use the Calculator:

- Enter your Annual Income to determine your applicable tax rate.

- Input the Cost of Purchase for the crypto asset.

- Provide the Amount of Sale to calculate your gains or losses.

- Select the Duration Held from the dropdown, indicating whether you've held the asset for more or less than a year.

- Click on the Calculate Tax button to get a breakdown of the tax due based on your inputs.

Why Use This Calculator:

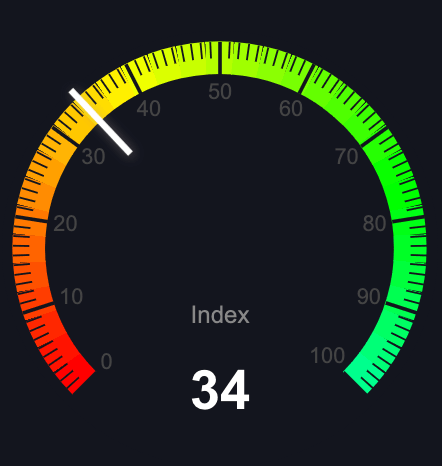

- Gain clarity on potential taxes owed for crypto transactions.

- Stay informed and avoid surprises during tax season.

- Benefit from accurate calculations tailored to Australian tax brackets and rates.

- Identify potential tax savings if assets were held for longer durations.

- Plan future trades with a clearer understanding of tax implications.